When you’re standing in the dealership lot, admiring that gleaming new tractor or combine harvester, the salesperson’s pitch sounds almost too good to be true: “Low monthly payments, quick approval, and you can take it home today!”

But beneath the surface of these attractive financing offers lies a complex web of hidden costs that can significantly impact your farm’s bottom line.

Understanding these concealed expenses isn’t just about saving money—it’s about protecting your operation’s financial health and making informed decisions that align with your long-term farming goals.

Let’s pull back the curtain on the equipment financing industry and reveal what dealers prefer to keep in the fine print.

The Psychology of the Sales Floor

Equipment dealers are skilled at focusing your attention on the monthly payment figure while glossing over the total cost of ownership.

This psychological tactic works because farmers, like most buyers, naturally gravitate toward immediate cash flow concerns rather than long-term financial implications. The result?

Many operators walk away with financing agreements that cost thousands more than anticipated.

Consider this scenario: A dealer quotes you $1,200 monthly payments for a $150,000 tractor over seven years.

Sounds reasonable, right? But that monthly figure might not include several mandatory add-ons that could push your actual payment to $1,500 or more. Over seven years, that $300 difference translates to $25,200 in unexpected costs.

Insurance: The Mandatory Money Drain

One of the most significant hidden costs in equipment financing is comprehensive insurance coverage. While dealers typically mention insurance is “required,” they rarely elaborate on the specific coverage levels or associated costs.

Full Coverage Requirements Lenders typically mandate comprehensive and collision coverage with low deductibles, often $500 or less.

For a $200,000 combine, this coverage can cost $3,000-$5,000 annually, depending on your location and claims history. Over a typical five-year loan term, insurance alone adds $15,000-$25,000 to your total equipment cost.

Gap Insurance Pressure Dealers often push gap insurance, which covers the difference between your loan balance and the equipment’s actual cash value if it’s totaled.

While this protection has merit, dealers typically mark up gap insurance premiums by 50-100% compared to what you’d pay through your regular insurance agent. A $2,000 gap insurance policy might actually be available for $800-$1,000 elsewhere.

Stored Equipment Coverage Many financing agreements require full coverage even when equipment sits unused during off-seasons.

This means you’re paying comprehensive insurance premiums year-round on a planter that only runs for three weeks in spring.

Some operators have successfully negotiated seasonal coverage adjustments, but dealers rarely volunteer this option.

The Balloon Payment Trap

Balloon payments represent one of the most dangerous hidden costs in equipment financing. These large, final payments can range from 15-40% of the original loan amount and often catch farmers off guard.

The Refinancing Gamble Dealers frequently present balloon payments as “no problem” because you can “just refinance when the time comes.”

However, this assumes several factors will align in your favor: stable or improved credit, favorable interest rates, and sufficient equity in the equipment. If any of these conditions aren’t met, you could face financial disaster.

Real-World Example A corn and soybean farmer in Illinois financed a $280,000 combine with a five-year loan featuring a $75,000 balloon payment.

When the balloon came due, the combine’s value had depreciated to $85,000, but his credit score had dropped due to two difficult growing seasons.

The bank demanded a $50,000 down payment for refinancing, money the farmer didn’t have. He was forced to sell the combine at a loss and lease older equipment at higher monthly costs.

Seasonal Cash Flow Misalignment Balloon payments typically come due on the loan’s anniversary date, which rarely aligns with harvest income.

This timing mismatch can force farmers to seek expensive bridge financing or make difficult equipment decisions during their cash-poor periods.

Early Termination Fees: The Exit Tax

Life happens, and sometimes farmers need to exit equipment financing agreements early. Unfortunately, most contracts include punitive early termination fees that can cost thousands of dollars.

Prepayment Penalties Some lenders charge prepayment penalties ranging from 1-5% of the remaining loan balance.

On a $100,000 remaining balance, this could mean $1,000-$5,000 in fees just for paying off your loan early. These penalties are often buried in the contract’s fine print and rarely discussed during the sales process.

Lease Termination Costs Equipment leases typically include even more severe early termination penalties. Beyond the remaining lease payments, you might face:

- Disposition fees ($500-$2,000)

- Excess wear and tear charges

- Mileage or usage overages

- Remarketing costs

Trade-In Complications If you want to trade your financed equipment for a newer model, negative equity can create significant costs. Dealers may roll this negative equity into your new loan, increasing your monthly payments and extending your debt burden.

Maintenance and Warranty Manipulation

Extended warranties and maintenance contracts represent another area where dealers inflate costs while presenting them as “essential protection.”

Inflated Service Contracts Dealers often require extended warranties or service contracts as loan conditions.

While these agreements provide peace of mind, dealer markups can be substantial. A $15,000 extended warranty might cost $8,000-$10,000 if purchased independently from the manufacturer.

Maintenance Clause Restrictions Some financing agreements include maintenance clauses requiring service at authorized dealerships using OEM parts.

This restriction eliminates your ability to shop for competitive service rates or use aftermarket parts, potentially increasing your maintenance costs by 20-40% over the equipment’s life.

Warranty Voiding Tactics Dealers sometimes claim that using independent mechanics or non-OEM parts will void your warranty, even when this isn’t legally true. This misinformation keeps farmers tied to expensive dealership service departments.

Interest Rate Games

While the advertised interest rate gets attention, the actual cost of money in equipment financing involves several hidden elements.

Promotional Rate Limitations Those attractive 0.9% or 1.9% promotional rates often come with strict limitations:

- Short loan terms (12-24 months)

- High down payment requirements (20-30%)

- Excellent credit score requirements (740+)

- Specific model restrictions

Most farmers don’t qualify for these rates, but dealers use them to attract customers before steering them toward higher-rate alternatives.

Rate Markup Profits Dealers typically receive compensation from lenders for interest rate markups. If you qualify for a 4.5% rate, the dealer might quote 5.5% and pocket the difference. This practice, called “dealer reserve,” can add thousands to your total interest costs.

Variable Rate Risks Some equipment loans feature variable interest rates that can increase over time. A loan starting at 3.5% might climb to 6.5% or higher if market rates rise. Dealers often downplay this risk, focusing instead on the attractive initial rate.

The Fine Print Minefield

Equipment financing contracts contain numerous provisions that can create unexpected costs and restrictions.

Usage Limitations Many contracts include usage restrictions that aren’t clearly explained. Exceeding specified annual hours or acres can trigger penalty fees or accelerated payment demands. A combine lease might limit usage to 300 hours annually, but dealers rarely emphasize this restriction during sales discussions.

Modification Restrictions Financing agreements often prohibit equipment modifications without lender approval. This can prevent farmers from installing aftermarket precision agriculture systems or making operational improvements that could enhance productivity.

Location and Use Restrictions Some contracts restrict where equipment can be used or stored. Moving financed equipment across state lines or using it in custom farming operations might violate your agreement and trigger penalties.

Due Diligence: Your Financial Protection Strategy

Protecting yourself from hidden costs requires thorough preparation and careful contract review.

Pre-Shopping Preparation Before visiting any dealership:

- Obtain independent financing quotes from banks and credit unions

- Research insurance costs through your agent

- Determine your realistic budget including hidden costs

- Identify your must-have features versus nice-to-haves

Contract Review Essentials Never sign any financing agreement without carefully reviewing:

- Total cost of ownership calculations

- All fees and penalties

- Insurance requirements and costs

- Maintenance obligations

- Early termination provisions

- Usage restrictions

Professional Consultation Consider involving professionals in major equipment purchases:

- Have your accountant review tax implications

- Ask your attorney to explain complex contract terms

- Consult with your insurance agent about coverage requirements

- Get independent appraisals for trade-in values

Negotiation Strategies That Work

Armed with knowledge about hidden costs, you can negotiate better deals.

Separate Financing from Equipment Don’t let dealers bundle financing with equipment purchases. Get independent financing quotes first, then use these as leverage in negotiations. Often, you can secure better terms through banks or credit unions.

Question Every Fee Challenge every additional charge. Ask for detailed explanations of documentation fees, processing charges, and other add-ons. Many of these fees are negotiable or can be eliminated entirely.

Alternative Insurance Arrangements Negotiate the right to provide insurance through your existing agent rather than accepting dealer-arranged coverage. This often results in significant savings while maintaining required protection levels.

The Technology Factor

Modern equipment financing increasingly involves technology-related costs that dealers may not fully disclose.

Software Subscriptions Many new machines require ongoing software subscriptions for full functionality. These annual fees can range from $1,000-$5,000 per machine and typically aren’t included in financing calculations.

Data Plans and Connectivity Precision agriculture features often require cellular data plans or satellite connectivity. These monthly charges can add $50-$200 per month to your operating costs.

Technology Obsolescence Risk Rapid technological advancement means today’s cutting-edge features may become outdated before your loan matures. This obsolescence risk isn’t reflected in financing terms but can significantly impact resale values.

Building Long-Term Equipment Strategies

Understanding hidden costs should inform your broader equipment acquisition strategy.

Lifecycle Cost Analysis Evaluate equipment purchases based on total lifecycle costs rather than just acquisition price. Include financing costs, insurance, maintenance, fuel, and eventual disposal or trade-in values.

Timing Considerations Plan equipment purchases around your farm’s cash flow cycles. Avoid financing during low-income periods when additional costs are most burdensome.

Diversification Benefits Consider diversifying your equipment financing sources. Using multiple lenders can provide negotiating leverage and reduce your dependence on any single financial institution.

The Bottom Line

Equipment financing hidden costs can add 20-40% to your total equipment investment. A $150,000 tractor might actually cost $180,000-$210,000 when all hidden expenses are included.

For farmers operating on tight margins, these additional costs can mean the difference between profit and loss.

The key to protecting your operation lies in thorough preparation, careful contract review, and aggressive negotiation.

Don’t be afraid to walk away from deals that include excessive hidden costs. Remember, the best financing deal is often the one that provides transparency rather than the lowest advertised rate.

Your farm’s financial health depends on making informed equipment decisions. By understanding and preparing for hidden costs, you can make choices that support your operation’s long-term success rather than creating unexpected financial burdens.

Equipment dealers will continue using these practices because they work. But armed with knowledge about hidden costs, you can level the playing field and secure financing that truly serves your farm’s interests.

The next time you’re in a dealership, remember that the most expensive equipment purchase is often the one you don’t fully understand.

Also Read

7 Best-Selling Tractor Brands in Africa: A Comprehensive Overview

Combine Harvester Prices in Kenya (2025): A General Buyer’s Guide

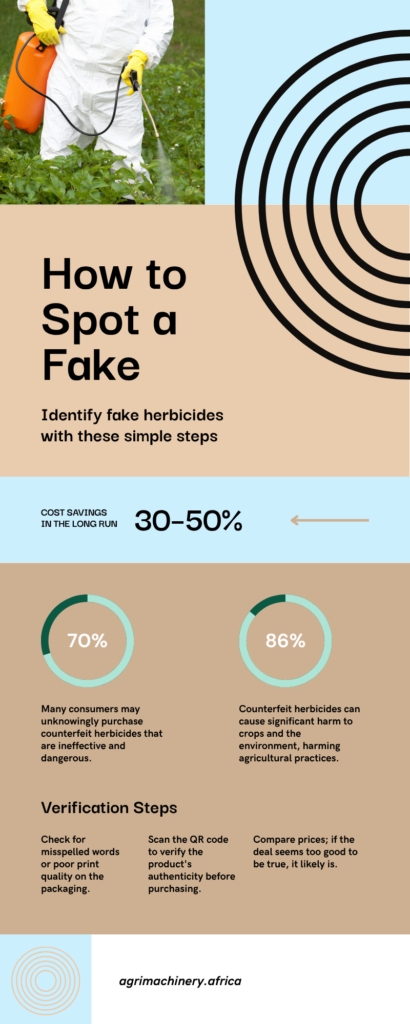

3. How to Verify the Authenticity of Your Herbicide

3. How to Verify the Authenticity of Your Herbicide