A new analysis by StoneX Financial Inc. has revealed a sharp deterioration in the economic balance between input costs and grain market returns, with the fertilizer-to-corn price ratio reaching a historic low in mid-2025.

According to the firm’s senior fertilizer strategist, this imbalance is straining profitability for American corn producers and raising broader concerns across the global agriculture sector.

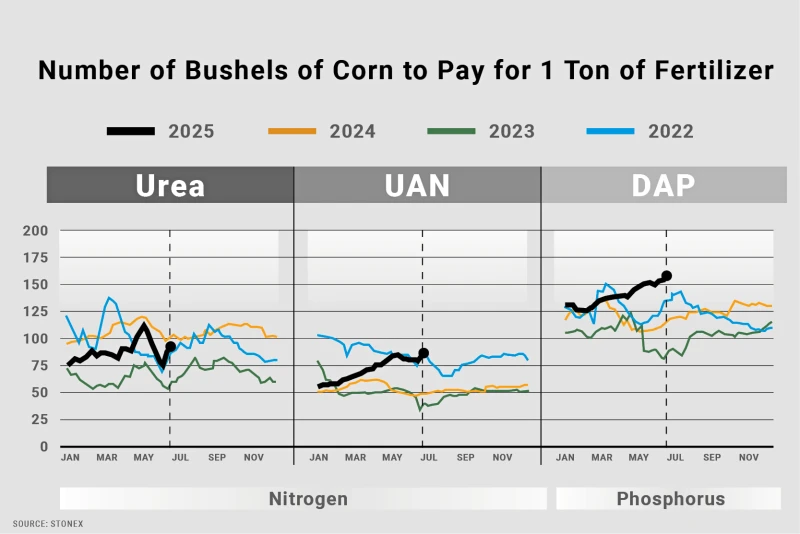

The fertilizer-to-corn ratio measures how many bushels of corn a farmer must sell to cover the cost of fertilizer—one of the largest annual input expenses.

That number is now at its worst in decades, driven by persistently high fertilizer prices and stagnant corn market performance. The report highlights this as a “worst-case scenario” for growers planning their 2026 crop season.

Nitrogen-based products like urea and UAN, along with phosphate fertilizers, have remained stubbornly expensive, largely due to global energy volatility and constrained supply.

Fertilizer production is highly energy-intensive, and recent geopolitical instability—particularly production disruptions in the Middle East and export limitations in North Africa—has pushed input prices higher.

While prices for some commodities have begun to normalize following the supply chain shocks of 2022–2023, fertilizer has proven more resilient to downward correction.

StoneX notes that current pricing levels for phosphate fertilizers, when benchmarked against December corn futures, have reached a level not seen in over 15 years.

Corn Prices Fail to Keep Pace

At the same time, corn prices have remained under pressure. A combination of large carryover stocks, subdued global demand, and uncertain export flows has weighed on futures contracts.

With domestic inventories well above average and a competitive global grain landscape—including strong harvests in Brazil and Ukraine—U.S. corn remains priced at a disadvantage.

This stagnant pricing, against the backdrop of rising input costs, has pushed the cost-to-return margin toward unsustainable levels for many producers.

Farmers are already responding. In several Corn Belt states, there has been a noticeable shift in planting intentions, with more acreage projected for soybeans and wheat in 2026—both of which require fewer fertilizer inputs.

However, agronomists and economists warn that cutting back on fertilizer usage without proper nutrient planning could reduce yields enough to erase any savings.

StoneX cautions that while reducing fertilizer application may appear attractive in the short term, it introduces significant risk. Yield loss, if poorly managed, could worsen profitability rather than improve it.

The implications of this price imbalance extend beyond the United States. Many emerging economies rely heavily on imported fertilizers and staple crop imports such as corn.

When the cost of growing food rises in major producing countries, those effects are often passed down through global trade routes—resulting in higher prices for food-importing nations.

In countries with limited input subsidies or constrained foreign exchange reserves, reduced fertilizer application may translate into lower agricultural output and heightened food inflation. This creates a ripple effect that threatens both regional food security and political stability.

Market Outlook: Relief May Be Slow

Analysts at StoneX believe that unless there is a significant correction in fertilizer markets or a rally in corn futures, the current imbalance is likely to persist into 2026.

Some easing of input costs could come if global natural gas prices fall or if new supply from major producers—including the U.S., Russia, and North Africa—enters the market.

In the long term, increased investment in precision agriculture, soil nutrient monitoring, and alternative fertilization methods may help buffer against such volatility. However, the immediate priority for farmers is managing risk and ensuring operational viability under constrained margins.

The widening gap between fertilizer costs and corn revenue underscores a growing structural challenge in agricultural economics.

While supply and demand fundamentals will eventually rebalance, the current scenario requires a measured, strategic response from producers, agribusinesses, and policymakers alike.

StoneX’s warning serves as a timely reminder that farm profitability is deeply tied to global commodity cycles, and that managing this balance effectively is critical to ensuring both food security and economic sustainability across the agricultural value chain.

Also Read

Top Agriculture Stocks to Watch in 2025: Global Picks for a Growing Sector

Fake Farm Inputs: Counterfeit Crisis Threatens Kenya’s Agriculture